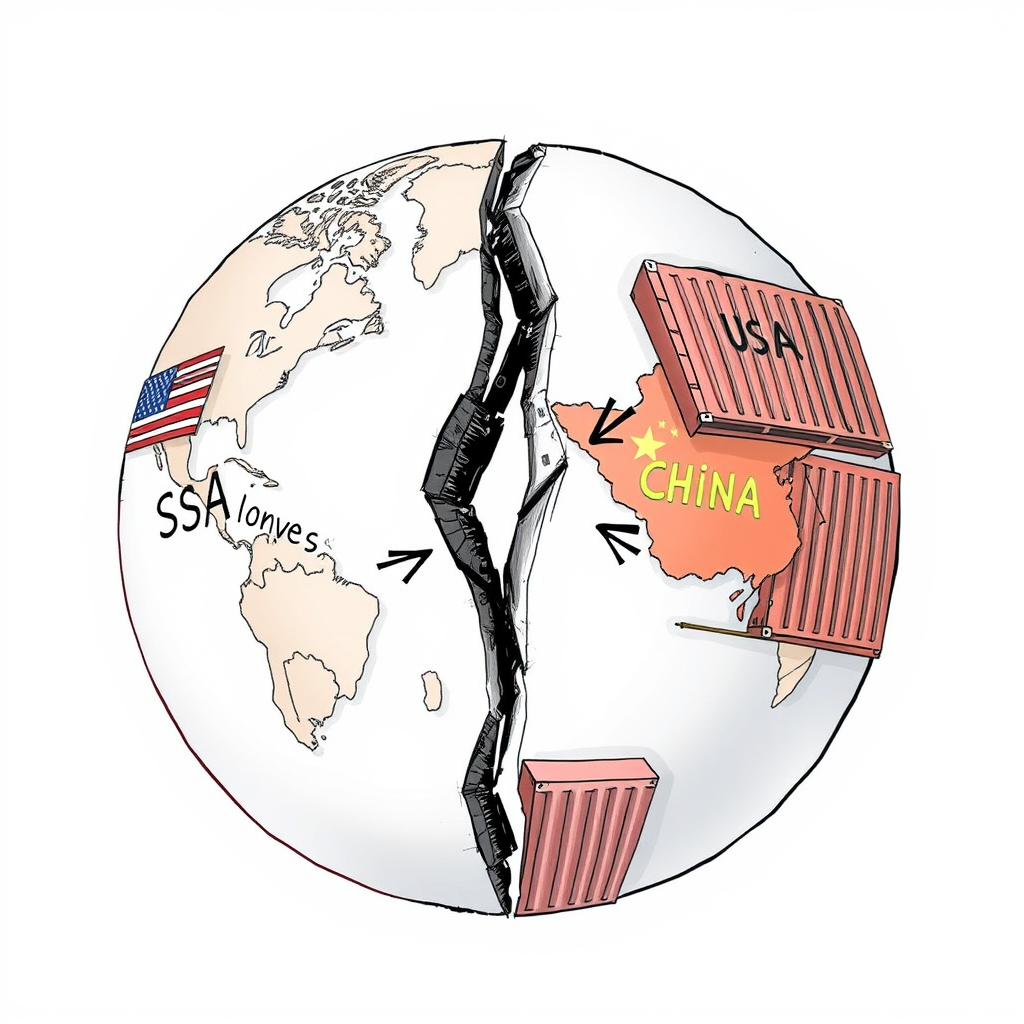

US-China Trade War: What’s Being Blocked?

The escalating trade dispute between the United States and China continues to reshape global commerce, marked by substantial tariffs and a widening economic impact. Currently, the US has imposed a 104% tariff on Chinese imports, prompting a retaliatory 84% tariff from China – a significant increase from the previous 34% levied on US products. Considering the two nations collectively generate 43% of global economic output – a figure projected by the International Monetary Fund for 2025 – the implications are far-reaching.

In 2023, US exports to China included key agricultural products like soybeans and corn, alongside crucial industrial components such as crude petroleum, integrated circuits, and specialized machinery. The Financial Express reports significant sales in areas like gas turbines, vaccines, and even beauty products. Intel, for example, derives 29% of its global revenue from the Chinese market, highlighting the country’s importance to major US corporations.

Conversely, China’s exports to the US in 2023 encompassed a broad spectrum of goods, from consumer electronics like broadcasting equipment and toys to industrial components such as office machine parts and electric batteries. Furniture, clothing, and medical instruments also feature prominently.

The trade war is demonstrably impacting trade flows. US exports to China decreased by 2.9% in 2024 compared to the previous year, while Chinese imports to the US rose by 2.8%, exacerbating the existing trade deficit. In 2024, the US goods trade deficit with China reached $295.4 billion, a 5.8% increase from 2023. Despite this, China remains a vital trading partner, accounting for 13.4% of all US imports.

Certain sectors are particularly vulnerable. The high-tech industry faces significant pressure, with China importing approximately $10 billion in US-made chips annually, including $8 billion in central processing units from Intel. Agricultural and farm equipment manufacturers like Caterpillar, Deere & Co, and AGCO are also feeling the pinch due to Beijing’s 34% duty on these products.

The broader global economy is at risk. Beyond the direct impact on bilateral trade and investment, China’s substantial goods surplus – around $1 trillion – presents a potential challenge. The possibility of offloading excess products onto international markets could flood global supply chains with low-cost goods, putting pressure on domestic manufacturers worldwide.

While both sides likely believe they are pursuing strategies to protect their economic interests, the current trajectory appears unsustainable. A prolonged trade war benefits no one. The focus should shift towards negotiation and finding mutually beneficial solutions that foster a more stable and predictable global trading environment. The current situation underscores the interconnectedness of the global economy and the need for collaborative approaches to address trade imbalances and ensure sustainable economic growth.