Trump's Tariffs: Chaos, Costs, and What's Next

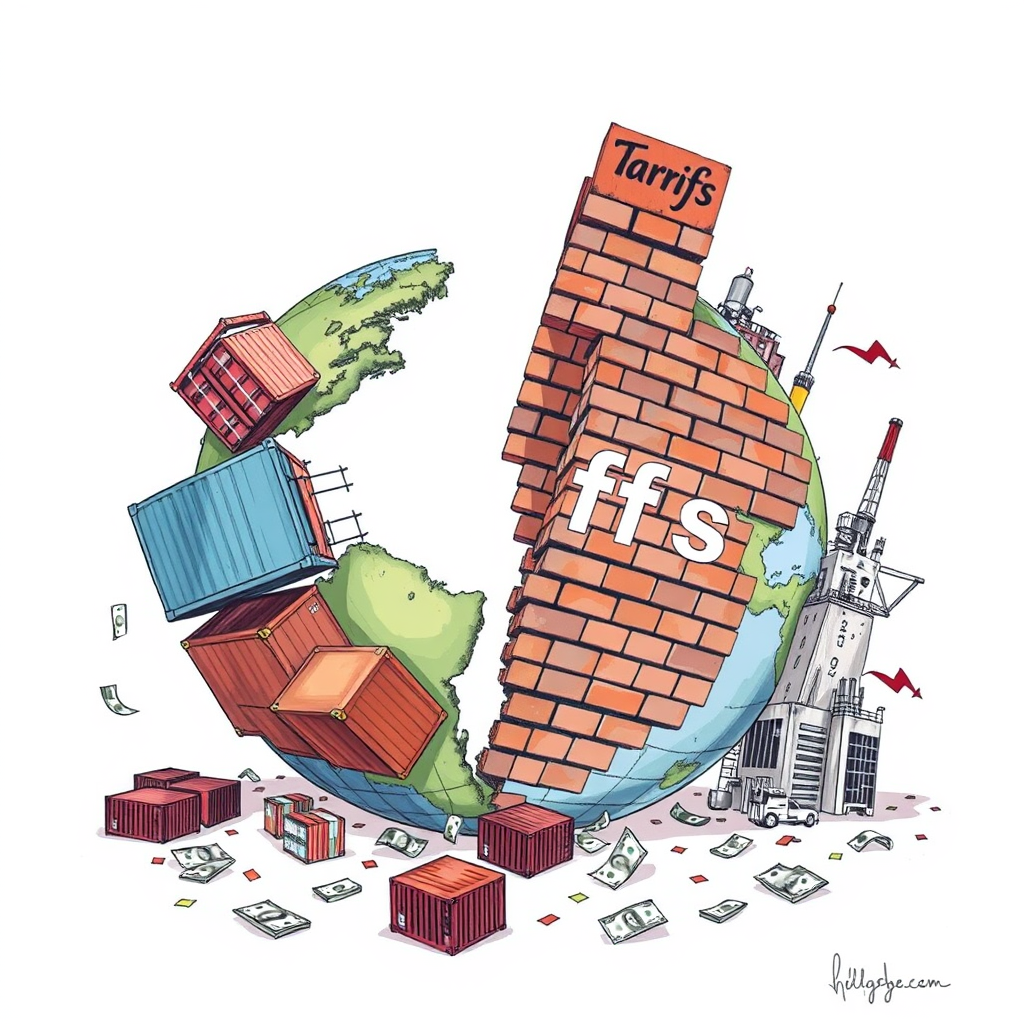

President Donald Trump’s sweeping new tariffs are already sending shockwaves through the US and global economies, sparking fears of a full-blown trade war. Announced on April 2, the tariffs – a minimum of 10 percent on nearly all imports – triggered an immediate plunge in the stock market, with the S&P 500 dropping over 4 percent on Thursday. While the administration frames the move as a bold step towards economic independence and a revival of American manufacturing, economists largely condemn it as a profoundly misguided and harmful policy.

The core of Trump’s strategy rests on the belief that making foreign goods more expensive will incentivize companies to invest in domestic production, ultimately lowering prices for American consumers. He celebrated the tariff implementation as “Liberation Day,” asserting that the US has been “ripped off” for decades. However, this logic is widely disputed. Critics point to a flawed calculation method for “reciprocal” tariffs – dividing a country’s trade surplus with the US by its total exports and then halving the result – as evidence of a fundamental misunderstanding of economic principles. The formula fails to account for factors like a nation’s economic capacity and purchasing power.

Public opinion appears to be turning against the tariffs. Trump’s approval ratings have fallen to their lowest point since taking office, with polls indicating that only 37 to 45 percent of Americans approve of his economic performance. A recent CBS News/YouGov poll revealed that a majority believe Trump is prioritizing tariffs over reducing prices.

The impact on consumers is expected to be significant. Prices for a wide range of goods – from cars and electronics to clothing and groceries – are likely to increase. Trump has announced a 25 percent tariff on all foreign-assembled cars and plans further tariffs on car parts. Countries heavily involved in manufacturing these goods – China, Taiwan, and South Korea – will be particularly affected.

Economists project a $3,789 decline in disposable income for the average US household and a 0.87 percent decline in American economic growth in 2025. J.P. Morgan has raised the probability of a recession from 30 to 40 percent. The global economy is also reeling, with stock indices falling worldwide. Countries like Cambodia and Vietnam, which host manufacturing operations for American companies like Nike and Apple, are expected to suffer disproportionately.

Notably, Russia and North Korea were exempted from the tariffs, a decision the White House justifies by citing existing sanctions. However, other sanctioned countries, like Venezuela, were not spared. This inconsistency raises questions about the administration’s motivations.

While the White House acknowledges the potential for short-term pain, there’s no guarantee of a long-term payoff. The tariffs represent a risky gamble with the US and global economies, and the early signs are deeply concerning. The administration’s insistence on a protectionist approach, despite widespread economic warnings, suggests a willingness to prioritize political rhetoric over sound economic policy. It remains to be seen whether this strategy will ultimately benefit American workers and consumers, but the current trajectory points towards increased economic instability and a potentially prolonged trade war.