Trump's Tariffs Accidentally Cripple Russia's War Funding

The Trump administration’s recent implementation of tariffs across numerous countries included a notable omission: Russia. Initial explanations from the White House centered on existing sanctions already limiting US-Russia trade. However, this justification feels incomplete. The US did impose tariffs on countries with similarly minimal trade volume, suggesting the decision wasn’t solely based on trade statistics. Conflicting statements emerged, with one advisor citing a desire to avoid complicating ongoing negotiations regarding Ukraine – a country receiving the 10% tariff.

The true, and arguably unintended, consequence of this exclusion is a growing strain on the Russian economy, particularly its crucial energy sector. Global oil prices have been falling, fueled by fears of a US-China trade slowdown and potential recession. While a temporary pause in some tariffs offered a brief respite, prices continue to decline, reaching levels not seen since the height of the Covid-19 pandemic.

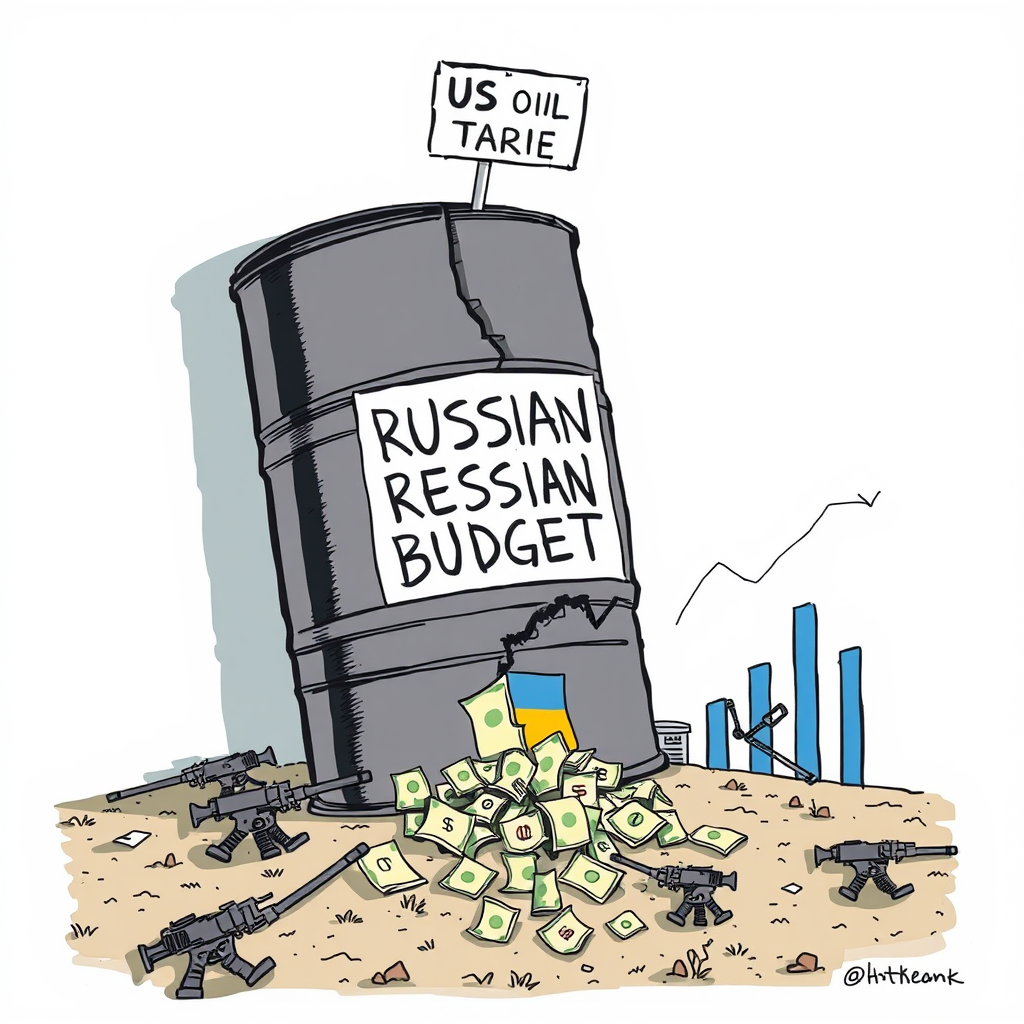

This is deeply problematic for Russia, which relies on oil and gas revenue for roughly a third of its government funding – a figure it recently bolstered with a 25% increase in defense spending to support its war in Ukraine. Russian Urals crude recently plummeted to $50 a barrel, significantly below the $70 budgeted for 2025.

For over two years, the war in Ukraine has created a paradoxical cycle: geopolitical instability drives up oil prices, which in turn funds Russia’s war effort. The current price drop threatens to disrupt this cycle, offering a potential, if slow-moving, economic pressure point. Ukrainian officials have openly acknowledged this, with Andriy Yermak, chief of staff to President Zelenskyy, stating that lower oil prices will diminish Russia’s war funding.

Western governments have historically hesitated to aggressively target Russian energy exports, fearing spikes in global prices. Complex mechanisms have allowed Russia to continue selling oil internationally despite sanctions. However, the current situation presents a unique dynamic.

While Russia’s war machine won’t collapse immediately, its economic vulnerabilities are growing. Stagnant growth and high inflation leave little room for maneuver, and collapsing oil prices are a significant threat. It’s a striking irony that a trade policy seemingly designed not to harm Russia may prove to be a more effective tool for weakening its economy and bolstering Ukraine than policies pursued by the Biden administration. The unintended consequences of this tariff strategy could be substantial, and it’s a development worth watching closely.