Trump Tariffs Trigger Russian Oil Price Crisis

Russia’s oil-dependent economy is facing increasing strain as global oil prices plummet, triggered by escalating trade tensions and new tariffs imposed by the United States. Oil prices dipped to as low as $60 per barrel on Monday, with Russia’s Urals crude nearing the $50 mark – a significant drop that’s raising alarms in Moscow.

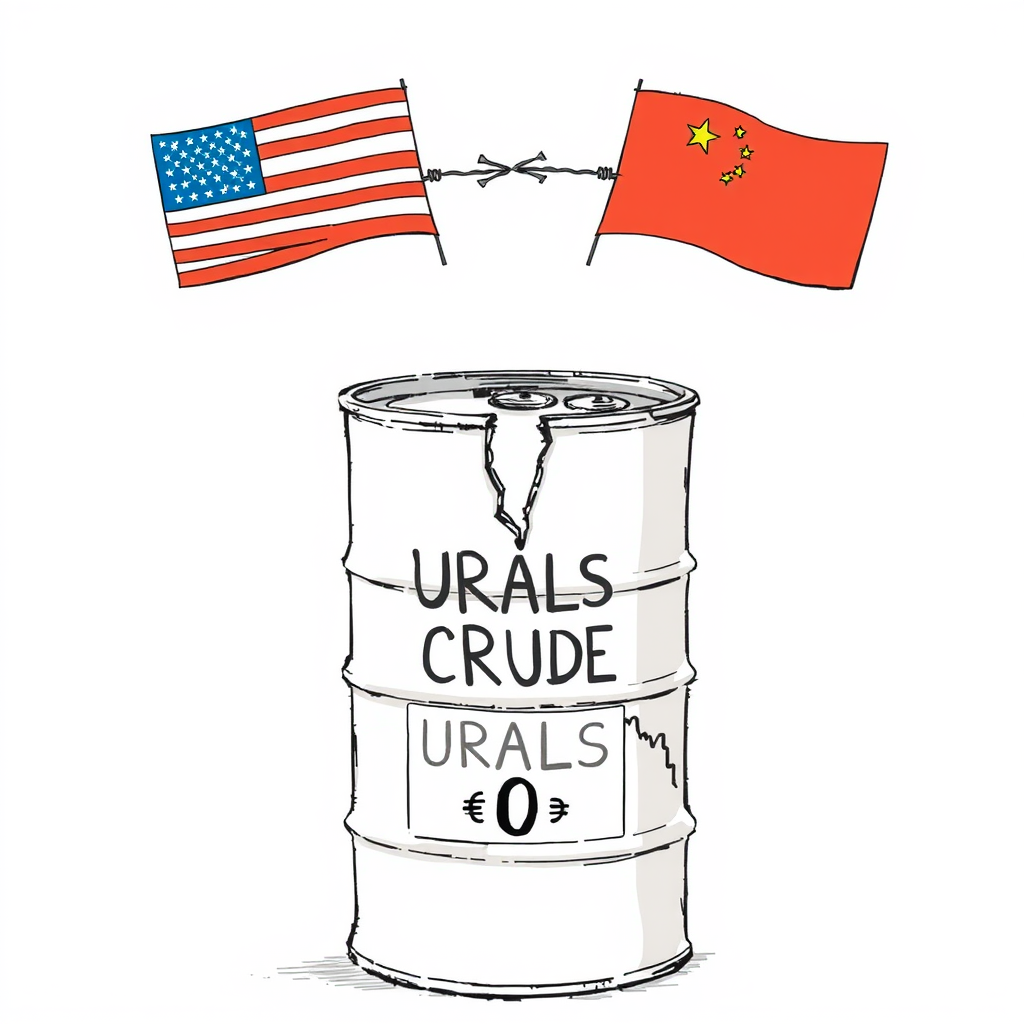

The downturn is directly linked to reciprocal tariffs announced by former President Donald Trump, who pledged to levy duties on nations imposing tariffs on the US, alongside a blanket 10% tariff on all imports. This move has sent shockwaves through global markets, with oil, commodities, and stock markets experiencing a sharp decline. China responded with retaliatory tariffs, further exacerbating the situation.

The oil and gas sector is a cornerstone of the Russian federal budget, contributing the largest share of revenue. In March alone, revenue from this sector fell by over 17% year-over-year, and this decline is accelerating following Trump’s tariff announcement. Kremlin spokesman Dmitry Peskov acknowledged the importance of oil prices for the budget, stating authorities are closely monitoring the “extremely turbulent” situation and seeking measures to mitigate the economic impact.

As of Friday, Russia’s Urals crude was trading at a low of $52 per barrel at the Baltic Sea port of Primorsk. The price continued to fall on Monday, edging closer to the $50 threshold. Globally, WTI Crude (Texas crude) also hit a low of $60 per barrel, while Brent Crude fell to $64.

The market volatility has sparked fears of a potential global recession, with trillions of dollars lost across markets in just 72 hours. However, President Trump downplayed these concerns, asserting that falling oil prices demonstrate the absence of inflation. He took to his social media platform, Truth Social, to highlight the decline in oil and food prices, and to blame China and past US leadership for the current situation. He also criticized China’s retaliatory tariffs and claimed the US is benefiting from tariffs already in place.

While Trump frames the situation as a positive for the US, the reality is far more complex. The tariff escalation represents a significant risk to global economic stability. The interconnectedness of the global economy means that disruptions in one area, like oil markets, quickly ripple outwards, impacting countries and businesses worldwide. The current situation underscores the dangers of protectionist trade policies and the importance of international cooperation to maintain a stable and predictable global economic environment. The long-term consequences of these tariffs remain to be seen, but the immediate impact is clear: increased economic uncertainty and a growing threat of recession.