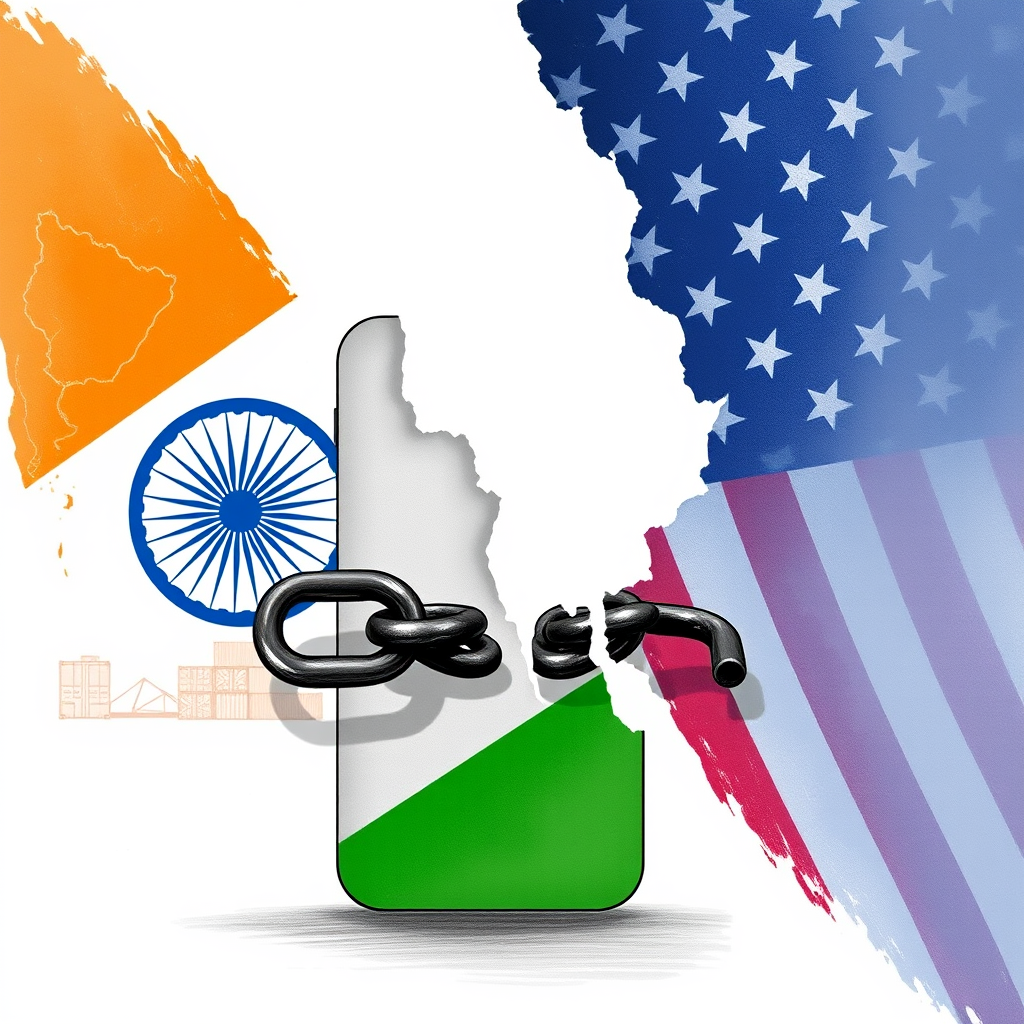

Trump Tariffs Threaten Apple's India Manufacturing Plans

India’s burgeoning ambition to become a global iPhone manufacturing hub faces a significant headwind as newly imposed U.S. tariffs threaten to undermine recent export gains and potentially stall Apple’s diversification efforts. The tariffs, described as “reciprocal” by the U.S., levy a 26% duty on goods imported from India, a rate lower than those applied to China (54%) and Vietnam (46%), but still substantial enough to raise concerns within the Indian electronics sector.

The U.S. represents India’s largest trading partner, accounting for 18% of its total goods exports. This makes the 26% tariff a potentially damaging blow to Indian shipments, profitability, and established supply chains. Ashok Chandak, President of the Indian Electronics and Semiconductor Association (IESA), highlighted the challenge, stating the tariffs “pose a significant challenge to India’s exports,” and could disrupt trade flows and squeeze profit margins.

Apple, which has already shifted 15% of its iPhone production to India, is particularly vulnerable. While seeking to lessen its reliance on China, the company now faces increased costs. Analysts predict the iPhone 16 Pro Max could jump to around $2,300 (approximately ₹1.9 lakh) if Apple passes the tariff burden onto consumers. The company’s stock experienced a sharp decline – over 8% – immediately following the tariff announcement, marking its worst single-day performance since 2020.

Despite this setback, India remains an appealing location for companies seeking to diversify their manufacturing base. The government is actively pursuing a bilateral trade agreement with the U.S., hoping to leverage Apple’s presence – alongside support from other tech giants like Microsoft and Google – to strengthen its negotiating position.

India’s smartphone export drive has been gaining momentum, with nearly ₹1 lakh crore worth of iPhones exported between April and January – a significant increase from the ₹60,000 crore exported during the same period last year. However, these gains are now at risk. Industry officials warn that companies may begin shifting new manufacturing operations to countries with lower tariff exposure.

While India may be comparatively “less hit” than other nations in the short term, the long-term implications of these tariffs remain uncertain. The situation underscores the fragility of global supply chains and the significant impact of trade policy decisions. It’s a clear signal that India’s path to becoming a major manufacturing powerhouse is not without obstacles, and requires proactive diplomacy and a strategic approach to trade negotiations. The tariffs aren’t simply a trade issue; they represent a potential roadblock to India’s economic aspirations and its ability to attract crucial foreign investment in the tech sector.