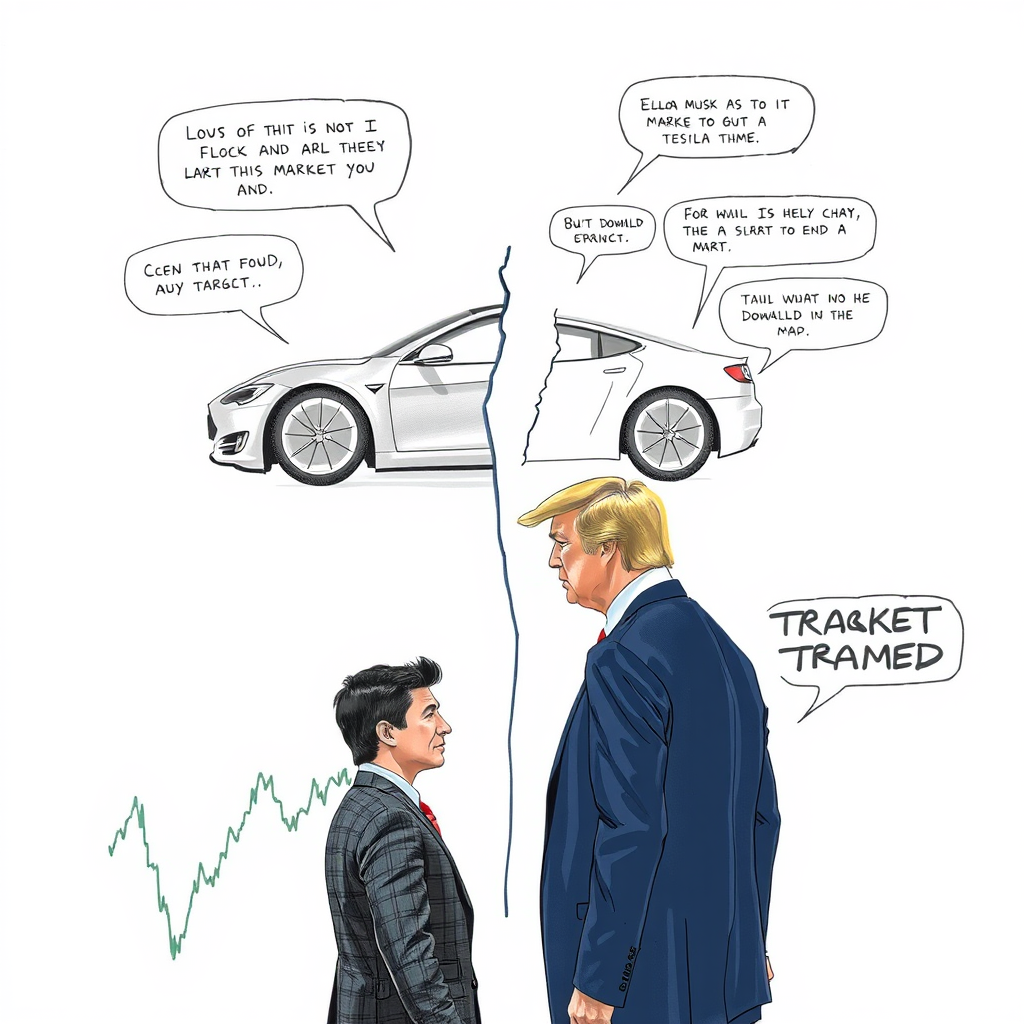

Tesla Stock Plunges as Musk and Trump Clash

Tesla stock experienced a significant downturn this week, falling 14% as a public dispute between CEO Elon Musk and former President Donald Trump escalated. Investors, who had hoped for stability following Musk’s departure from formal roles within the Trump administration last week, were instead confronted with a new source of uncertainty. The back-and-forth between the two figures appears to be directly impacting market confidence in the electric vehicle manufacturer. While the specifics of the dispute remain largely rhetorical, the market reaction demonstrates the sensitivity surrounding leadership dynamics and perceived risk associated with prominent, and sometimes unpredictable, figures like Musk. The immediate future for Tesla shares hinges on whether this public disagreement will subside or continue to fuel investor anxieties. It’s a clear reminder that even seemingly unrelated personal conflicts can have tangible consequences for publicly traded companies, particularly those heavily reliant on the vision and reputation of a single individual. The drop raises questions about the sustainability of Tesla’s valuation, which has often been driven more by future expectations than current earnings.