Rare Earths: Can America Break China’s Grip?

The story of rare earth minerals is a tale of strategic vulnerability, shifting global power, and a complex industrial challenge. Once a domestic success story – with the U.S. dominating production from the Mountain Pass mine in California as early as the 1950s – the rare earth supply chain is now overwhelmingly controlled by China, a situation that’s prompted alarm bells in Washington and spurred a frantic search for alternatives.

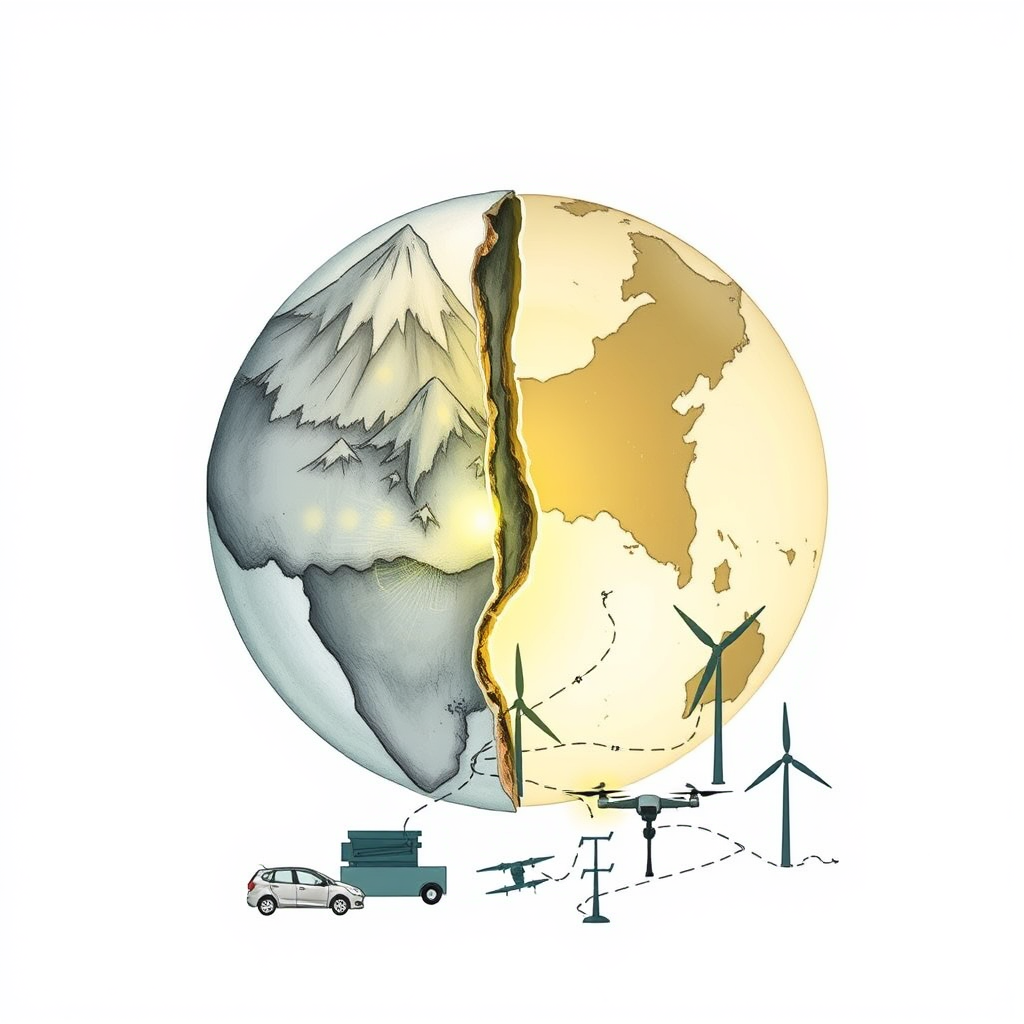

The current predicament isn’t simply about resource scarcity. Rare earth elements – a group of 17 chemically similar metals – are crucial components in a vast array of modern technologies, from electric vehicles and wind turbines to defense systems and consumer electronics. China recognized this strategic importance decades ago, investing heavily in mining, processing, and refining capabilities, and, crucially, accepting lower profit margins to build market share. This long-term strategy, coupled with lax environmental regulations for a period, allowed China to effectively monopolize the supply chain.

The U.S. is now scrambling to regain some level of independence. The recent focus on reopening and expanding domestic mining operations, like Mountain Pass and a planned facility in Texas by Lynas Rare Earths, is a step in the right direction. However, simply securing raw materials isn’t enough. The real bottleneck lies in processing and refining – separating the individual rare earth elements from the ore and purifying them to the required specifications. China currently dominates this crucial stage, and also controls much of the specialized equipment needed for refining.

The situation is further complicated by the fact that not all rare earth elements are created equal. Permanent magnets, vital for electric vehicle motors and other applications, require a specific combination of elements, including neodymium and, critically, dysprosium and terbium. China controls nearly 100% of the global supply of these heavier, heat-resistant elements, giving them significant leverage.

Efforts to diversify the supply chain are underway, with potential sources being explored in Australia, Brazil, Saudi Arabia, and even Ukraine and Greenland. However, these projects face significant hurdles, including technical challenges, high costs, and environmental concerns. The refining process is energy-intensive and generates substantial waste, requiring careful management.

The economic realities are stark. China’s established capacity and willingness to operate at lower margins create a significant price disadvantage for new entrants. Simply subsidizing domestic production isn’t a sustainable solution, as it distorts the market and invites retaliation. Tariffs, while potentially offering short-term relief, ultimately raise costs for businesses and consumers.

A truly effective strategy requires a multi-pronged approach. Investment in research and development is crucial to develop innovative refining technologies and reduce reliance on Chinese equipment. International cooperation with like-minded nations can help diversify the supply chain and create a more resilient system. And, perhaps most importantly, a long-term commitment to sustainable and responsible mining practices is essential to ensure that the pursuit of strategic independence doesn’t come at the expense of environmental protection.

The challenge is immense, but not insurmountable. The U.S. and its allies must recognize that regaining control of the rare earth supply chain is not just an economic imperative, but a matter of national security. It requires a sustained commitment, strategic investment, and a willingness to compete in a complex and rapidly evolving global landscape. The current situation is a clear lesson in the dangers of strategic dependence and the importance of building resilient supply chains for critical materials.