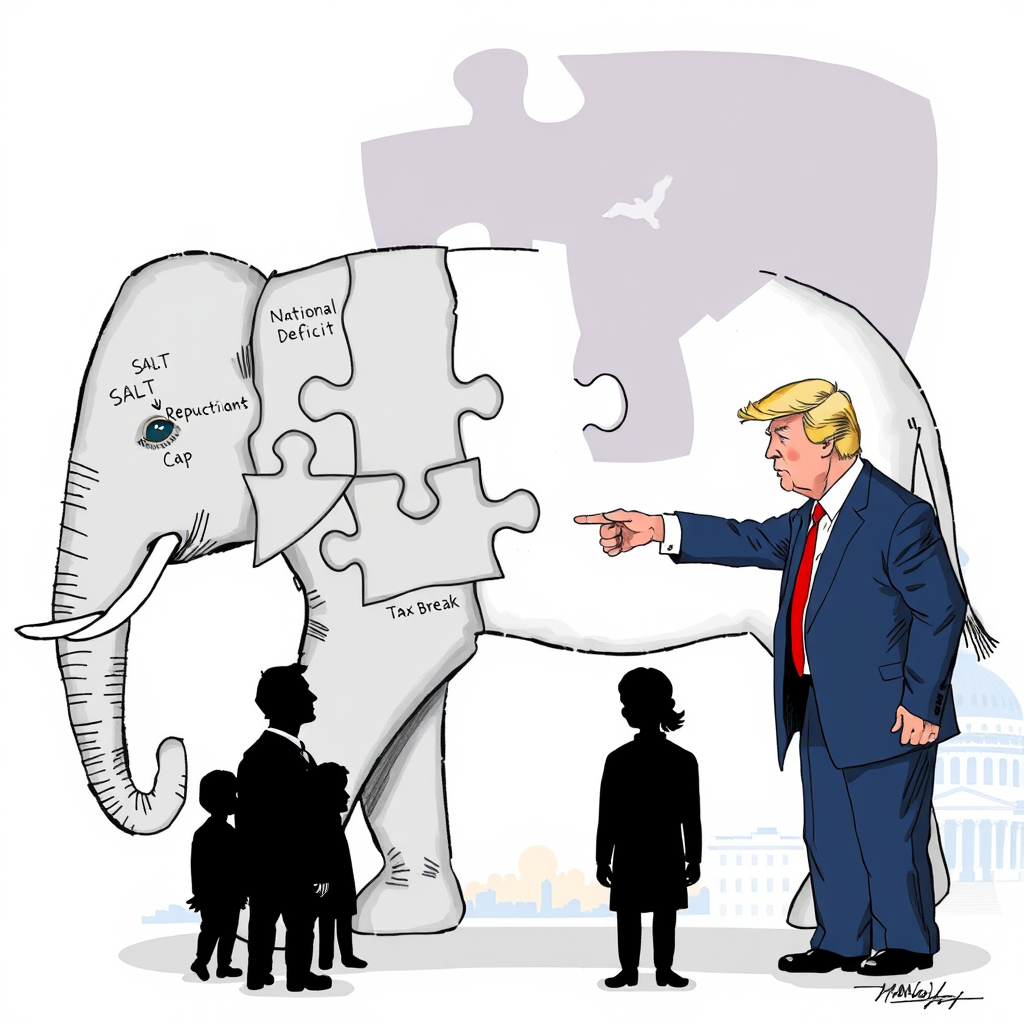

GOP Offers Tax Break to Win Votes

House Republican leaders are attempting to appease a group of conservative holdouts by offering a significant increase to the state and local tax (SALT) deduction cap, a move aimed at securing passage of a key spending bill championed by former President Donald Trump. The proposed compromise would raise the cap to $40,000 for individual filers and $80,000 for joint filers, a substantial jump from the current $10,000 limit.

The offer comes after five Republican lawmakers – Chip Roy of Texas, Ralph Norman of South Carolina, Andrew Clyde of Georgia, Josh Brecheen of Oklahoma, and Lloyd Smucker of Pennsylvania – publicly opposed Speaker Mike Johnson’s initial plan on Friday. These holdouts, along with others, are demanding deeper spending cuts and expressing concerns about the bill’s potential impact on the national deficit.

The SALT deduction has become a central point of contention. While a group of Republicans representing high-tax states are pushing for a $62,000 individual cap, conservatives generally oppose any increase, viewing it as a benefit primarily for Democratic-leaning coastal states. Politico reports that the offer of $40,000/$80,000 suggests leadership believes this is a viable compromise.

To offset the cost of the increased SALT deduction, Republicans are considering accelerating the implementation date for Medicaid work requirements, moving it up from 2029. Negotiations are ongoing, with Republicans planning to regroup as early as Monday.

The internal Republican struggle has drawn criticism from former President Trump, who took to social media urging his party to “STOP TALKING, AND GET IT DONE!” and fix the “MESS” left by the Biden administration.

This situation highlights the deep divisions within the Republican party and the challenges Speaker Johnson faces in uniting his caucus. While compromise is often necessary in legislative processes, the concessions being offered appear to be driven more by political expediency than sound fiscal policy. The willingness to potentially accelerate Medicaid work requirements to fund a tax break largely benefiting wealthier taxpayers in specific states raises questions about the priorities of Republican leadership. It remains to be seen whether this sweetener will be enough to secure the necessary votes and avoid a potential government shutdown.