Energy Markets Resilience Tested Amidst Iran Israel Crisis

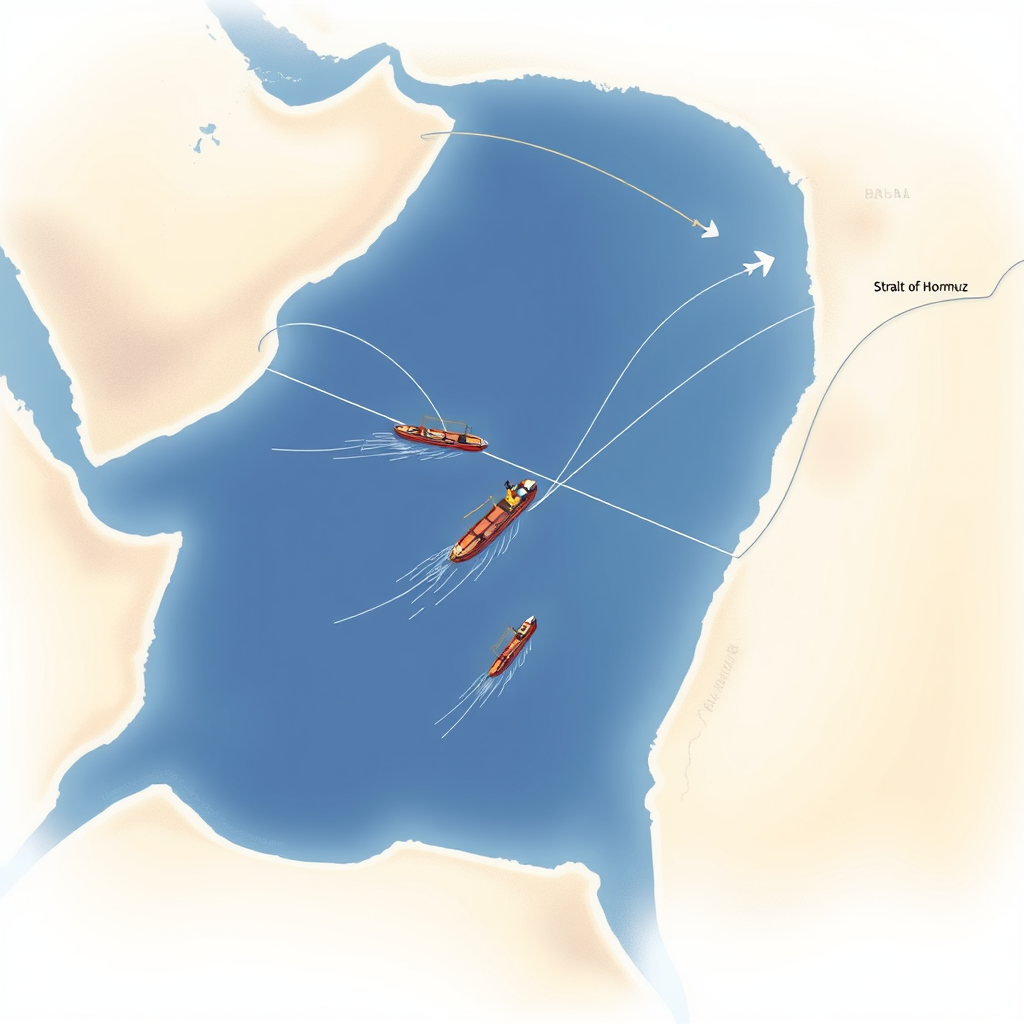

The recent escalation of tensions between Iran and Israel has, surprisingly, failed to trigger a significant energy crisis, a phenomenon experts are attributing to a growing resilience within global energy markets. Despite the potential for disruption in a critical chokepoint like the Strait of Hormuz – through which roughly 20 million barrels of crude oil and products flow daily – prices have remained relatively stable. This isn’t to say the situation is without risk, but rather that the market appears to have “baked in” a degree of geopolitical risk tolerance.

Former ODNI National Intelligence Manager for Iran, Norman Roule, suggests that markets are now more attuned to reacting to actual supply and demand disruptions, rather than simply geopolitical turbulence. The chronic instability in the Middle East, particularly since the 2019 attack on Abqaiq, seems to have fostered this resilience. The United States’ continued significant oil production also plays a key role, lessening immediate vulnerability.

Behind the scenes, the U.S. is likely coordinating with Saudi Arabia and the United Arab Emirates to discourage escalation, manage OPEC production, and prepare for potential increases in oil exports should the Strait of Hormuz be closed. Support for regional air defenses is also a priority. Washington is also preparing to work with global partners to potentially release strategic oil stockpiles, though Roule cautions against drawing down these reserves for purely political reasons.

Currently, oil prices are hovering in the upper $70s, with potential for spikes reaching $120-$140 should conflict intensify. While oil-producing nations would benefit from higher prices, developing countries with limited import reserves would likely suffer. Higher oil prices would also exacerbate inflation and potentially delay interest rate cuts.

Should Iran follow through on threats to close the Strait of Hormuz, Asian markets – particularly China, India, South Korea, Pakistan, and Japan – would be most affected. The U.S., however, imports relatively little oil from the region and would be less directly impacted.

Alternatives to the Strait of Hormuz exist, but none can fully compensate for its capacity. The Saudi East-West Pipeline, capable of carrying five million barrels per day, is one option, but would require shipments to pass through potentially unstable Yemeni waters. Emirati and Omani pipelines offer additional capacity, but are limited. Iran’s Jask Port, while offering some export potential, is also constrained.

Roule believes Iran is unlikely to fully close the Strait, recognizing the damage it would inflict on its own economy and international standing. Potential disruption tactics could range from GPS interference and cyberattacks to harassment of ships and, at the extreme, mining or missile attacks. The U.S. would likely respond swiftly, potentially with support from allies like the United Kingdom and India.

While OPEC+ possesses spare capacity, much of it is located in the Persian Gulf, making it vulnerable to disruption. China’s role remains largely consistent – continuing to purchase Iranian oil at discounted rates and prioritizing its own economic interests.

A wildcard to watch is the potential impact on natural gas supplies. Qatar, a major LNG producer, relies on the Strait of Hormuz for its exports. Any disruption to this flow could have significant consequences for global energy markets. Violence impacting the South Pars Gas Field, shared by Qatar and Iran, or Iranian attacks on Israel’s gas industry, could further complicate the situation.

Ultimately, the current situation highlights a shift in the dynamics of energy security. While geopolitical risks remain, markets appear better equipped to absorb shocks and adapt to changing circumstances. However, this resilience should not be mistaken for immunity. A prolonged or escalated conflict could still have significant consequences for the global economy. The ability to quickly and effectively coordinate responses, both diplomatically and militarily, will be crucial in mitigating these risks.