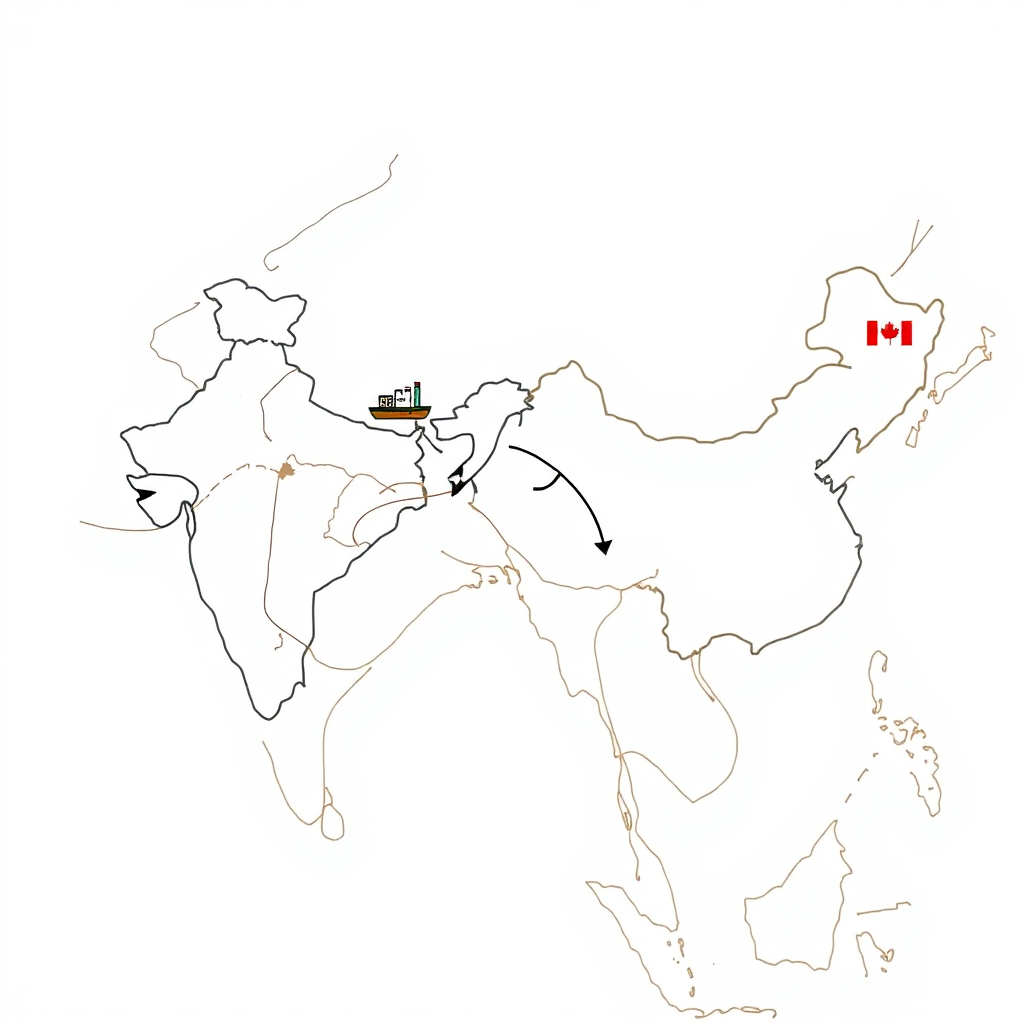

China Turns to India After Canada Tariff

China’s imposition of a 100% tariff on Canadian rapeseed meal and oil imports is dramatically reshaping global trade flows, with India poised to become a major beneficiary. Over the past three weeks, China has purchased 52,000 tons of Indian rapeseed meal – a fourfold increase compared to the entirety of 2024 and signaling a significant shift in sourcing strategies.

Industry sources indicate Chinese buyers turned to India following the March 20th tariff implementation, seeking alternatives to Canadian supplies. The purchases, priced between $220 and $235 per metric ton on a cost and freight basis, come as China, the world’s leading consumer of rapeseed meal, looks to secure animal feed supplies.

Historically, India has struggled to compete with Canada in the Chinese market due to price discrepancies. However, the tariffs have leveled the playing field, creating a unique opportunity for Indian exporters. In 2024, prior to the tariff, China imported 2.02 million metric tons of rapeseed meal from Canada, alongside 504,000 tons from the United Arab Emirates and 135,000 tons from Russia – a mere 13,100 tons came from India.

The sudden surge in demand is expected to boost India’s rapeseed meal exports, potentially increasing shipments from 2 million tons to 2.5 million tons this year, according to B.V. Mehta, executive director of the Solvent Extractors’ Association (SEA). This increase is supported by substantial rapeseed meal stockpiles in India and a global supply shortage. Domestic prices have already begun to reflect this shift, falling to around $200 per ton (FOB) from $248 in February and $278 a year ago, according to SEA data.

While South Korea, Bangladesh, Thailand, and Vietnam traditionally dominate India’s rapeseed meal export market, China’s growing appetite could quickly establish it as a primary buyer. If the current momentum continues, India is well-positioned to capitalize on this trade realignment. This situation highlights how quickly geopolitical factors and trade policies can reshape agricultural commodity markets, creating both challenges and opportunities for producers and exporters worldwide. The impact of this shift will be closely watched, not only by Indian and Canadian exporters but also by global feed producers and agricultural analysts.