Amazon Stock Plummets After Trump's Tariff Attack

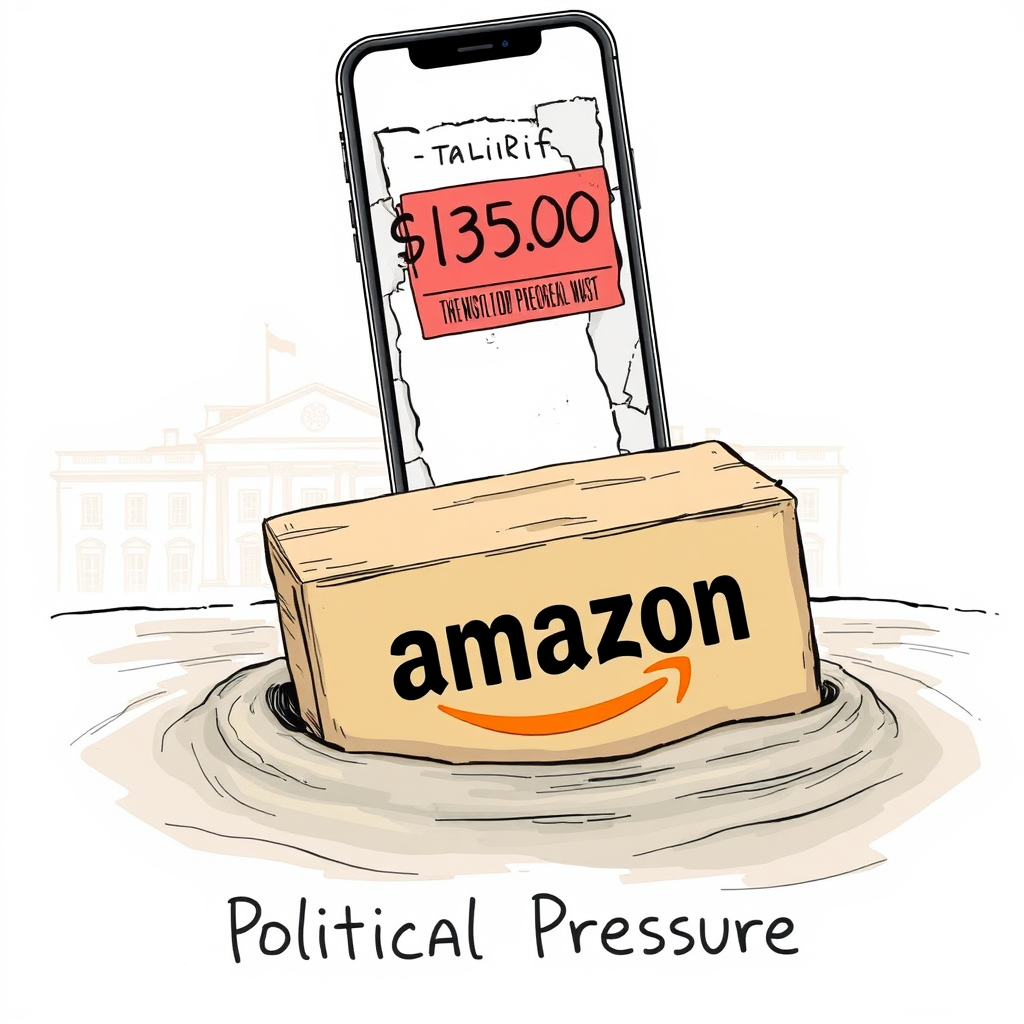

Amazon’s stock price experienced a swift $3.9 billion decline Tuesday following criticism from White House Press Secretary Karoline Leavitt regarding a planned feature displaying tariff costs on product listings. The 2% drop in value, calculated from Amazon’s $1.97 trillion market capitalization, occurred after Leavitt labeled the proposed feature a “hostile and political act” in response to a Punchbowl News report detailing the plan. The report indicated Amazon was considering showcasing the impact of President Trump’s tariffs on the price of goods sold on its platform.

According to two White House officials who spoke with CNN, President Trump personally contacted Amazon founder Jeff Bezos to express his displeasure with the initiative. The sources described the president as visibly angered by the report. Shortly after the call, Amazon issued a series of statements. An initial release clarified the feature was only under consideration for Amazon Haul, a separate platform. This was quickly followed by a revised statement asserting the plan had been scrapped entirely, stating it “was never approved and not going to happen.”

The incident highlights the ongoing, complex relationship between the tech giant and the Trump administration. Bezos and Trump publicly clashed during the president’s first term, largely stemming from critical coverage in The Washington Post, which Bezos owns. However, as Trump approached his second term, Bezos, along with other tech leaders like Mark Zuckerberg and Elon Musk, appeared to seek rapprochement, even attending the inauguration and Bezos personally donating $1 million.

Initial public reaction to the transparent tariff pricing was largely positive, with some, like journalist Victoria Brownworth, praising the idea on social media. However, that sentiment quickly shifted once news of Amazon’s reversal circulated. MSNBC’s Elise Jordan, among others, expressed disappointment, suggesting the company prioritized White House approval over customer transparency.

Amazon is set to release its first-quarter earnings report for 2025 on Thursday. The company generated $638 billion in revenue last year, placing it second only to Walmart in global sales.

This episode feels less about tariff transparency and more about political leverage. While consumers might benefit from knowing the tariff impact on prices, Amazon’s swift retreat suggests the company deemed maintaining a positive relationship with the White House more valuable than appearing consumer-friendly. It raises questions about the extent to which large corporations will self-censor to avoid political repercussions, and whether consumers are ultimately being served by this dynamic. The incident underscores the increasing intersection of commerce and politics, and the potential for political pressure to influence business decisions, even those seemingly aimed at greater transparency.